By Jack Hersch

- December 2023

Stock: Investors in distressed debt are counting on opportunities in various sectors in 2024. This optimism comes after the US economy has shown surprising strength this year and has set a less lucrative target than distressed players had expected.

At the end of 2022, investors saw a bear market in the rearview mirror that seemed to indicate anything from a mild to a severe recession in 2023.

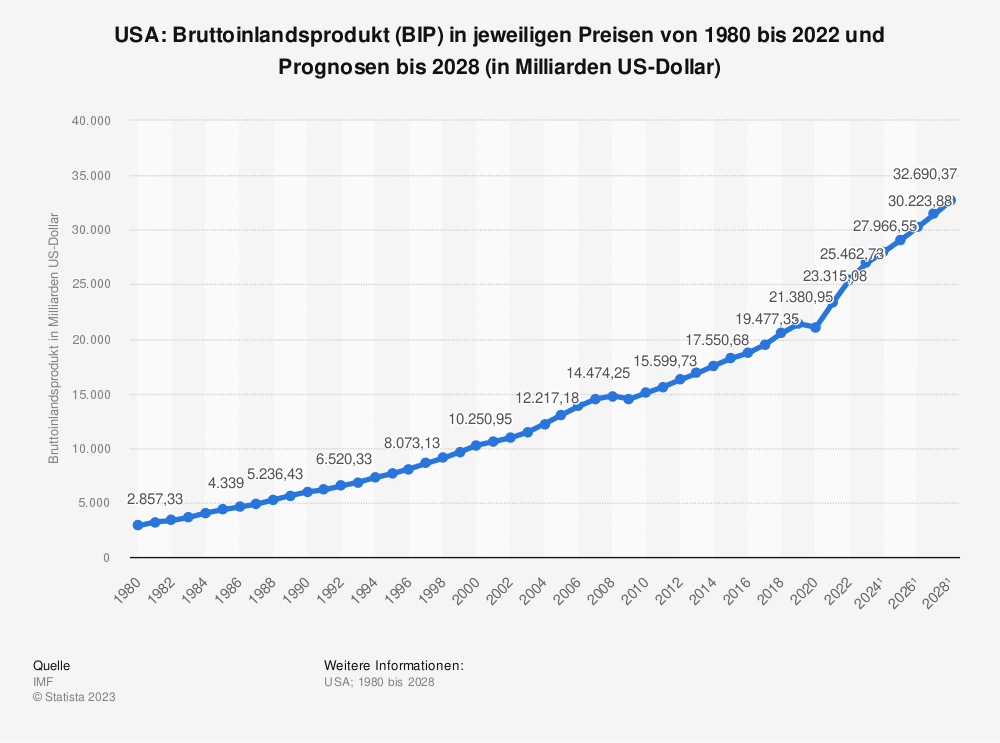

The inaccuracy of this crystal ball is now clear. GDP rose by 2.2%, 2.1%, and 5.2% in the first three quarters of this year, while inflation fell by almost two-thirds from its peak. Meanwhile, major stock and credit indices have surged.

So far, the S&P 500 has risen by 20% in 2023, and the Nasdaq has achieved an impressive return of 38%. In the credit markets, the Morningstar US High-Yield Bond Index has risen by 10.2%, while the Morningstar LSTA US Leveraged Loan Index has increased by 11.9% (all performance data as of December 8).

On the other hand, distressed investors have earned 4.99% according to the HFRI Distressed/Restructuring Index from Hedge Fund Research until November.

Burning money

The reason for the strong economic performance this year is not hard to see. 'The US economy has held up much better than expected in 2023 despite headwinds, largely due to a resilient consumer,' said Jim Wiant, CEO of the asset manager Capital Four US.

In fact, consumers in 2023 not only spent money as if they had money to burn, but they might also still have significant dry powder. Following the comprehensive update of the national accounts data in September by the US Bureau of Economic Analysis, analysts reported that more than $1 trillion in savings could remain in consumers' hands.

Given that the US consumer accounts for about 70% of GDP, this momentum might mean there will never be a post-pandemic recession. On the other hand, this spending could fuel inflation or at least prevent it from falling towards the Federal Reserve's stated 2% target. This, in turn, could tempt the Fed to keep the target rate for Fed Funds elevated, thus preempting a now widely anticipated monetary policy shift in early 2024.

Declining coverage

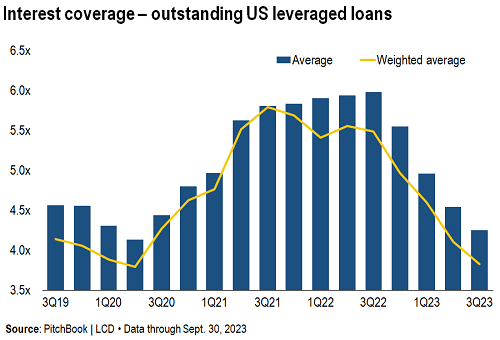

While stock and credit indices gained this year, US Treasury bonds collapsed, with both short-term and long-term yields rising and consequently the interest coverage shrinking (notably, a fierce rally in the fourth quarter significantly lowered yields).

In fact, the interest coverage of the Morningstar LSTA US Leveraged Loan Index fell to its lowest level since the start of the pandemic.

The declining interest coverage points to new distressed opportunities. To this end, the default rate on leveraged loans rose to 1.75% according to LCD in the summer before falling back to 1.48% in November. Looking ahead, S&P Global Ratings predicts that the default rate for Morningstar LSTA US Leveraged Loans could reach 2.75% by June 2024. (Note: The default rate for Morningstar LSTA loans does not include below-average buybacks and exchange offers).

S&P noted that the 12-month default rate of speculative corporate bonds in the U.S. rose to 4.07% in September, after hitting a low of 1.28% in April 2022. However, the speculative S&P default rate is below the annual rate of about 6.6%. At the end of 2020 and well below the over 10% rates of the previous three recessions.

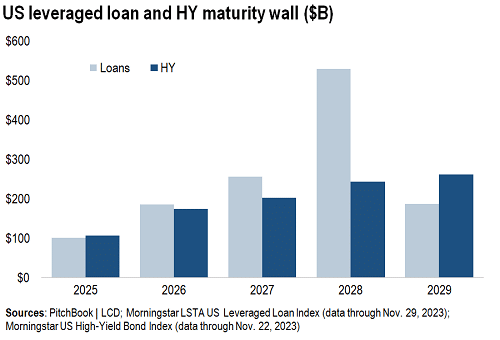

Stressed investors can also use maturity limits on debt to highlight potential opportunities that may arise in the future. Half of the credit debt maturing in the next few years has a rating of B-minus or lower. And in the coming years, the maturity cap of the Morningstar US High-Yield Bond Index is steadily increasing: $107 billion will mature in 2025, $174 billion in 2026, and a peak in 2029 at just over $260 billion.

The relatively weak issuance of high-yield bonds in the last two years raises concerns about meeting the requirements of such a wall. The issuance of high-yield debt exceeded the $200 billion mark per year in most years of the decade between the global financial crisis and the pandemic, as well as in two years in the middle of the pandemic.

But in 2022 and 2023, the annual high-yield issuance was significantly below $200 billion, and if this slow pace continues, the future ability of the bond market to absorb and refinance maturing debt could be problematic.

Money ball

Given the rising default rates, investors may be 'just at the end of the first inning' in reassessing risk, said Dan Zwirn, CEO and Chief Investment Officer of Arena Investors. He pointed out that leveraged acquisitions in recent years had high multiples and were financed with too much debt. As interest coverage is now declining, 'the unwinding of this leverage is just beginning,' he said.

Jay Weinberger, Managing Director of the Financial Restructuring Group at Houlihan Lokey, also believes that worse is to come for the economy and markets, noting that there has not yet been a significant rise in layoffs in the U.S., a classic leading indicator of an economic turnaround. He adds that the increase in layoffs we have seen is concentrated at the lower end of the wage scale.

Some investors believe that the damage the markets could suffer in an economic downturn may not be that great. Jeremy Burton, Managing Director and Portfolio Manager at PineBridge Investments, assumes that 'it is very unlikely that default rates will rise as sharply as in 2008 and 2009,' and that companies are likely to be spared from overwhelming shocks to their business operations.

Burton pointed out that while the U.S. high-yield market has shrunk in recent years, he believes the credit quality of the market remains 'fairly reasonable.' Combining these factors with the liquidity that is sloshing around the markets, Burton believes that if option-adjusted spreads of high-yield U.S. bonds rise above 400 basis points, 'bids will offset the risk' and prevent the OAS from rising too far above that level.

Jeff Jacob, partner and opportunistic portfolio manager at the global credit manager Marathon Asset Management, is a bit less optimistic. 'High-yield bonds will stay at 500 or less,' he said recently, pointing out that given the current yields on government bonds, 'the overall returns in the high-yield market will represent a floor for bond prices.'

Allan Schweitzer, portfolio manager at Beach Point Capital Management, agrees. Although he expects the US economy to slip into a recession in the second quarter of 2024, Schweitzer believes that US high-yield bonds are generally of higher quality compared to previous recessions. In connection with an increased absolute yield, this would mean that the OAS will be tighter than in other cycles, he said, adding that today's yields offer 'equity-like returns' that will attract capital.will attract.

As a result, Schweitzer predicts that the OAS will reach '550-600, but not much more' in the worst case, as low underlying dollar prices entice investors to enter.

When shifting the focus to leveraged loans, investors are less confident. Jacob from Marathon assumes that the spreads of leveraged loans could reach up to 675 basis points, while the default rate – including distressed exchanges – could reach 4% (he sees a default rate of 3% to 3.5% for high-yield bonds).

Morgan Stanley is somewhat more pessimistic regarding leveraged loans and predicts that the default rate will rise to 4.75% in 2024. On the other hand, Bank of America is more optimistic about loan defaults and sees a peak of 3.5% in 2024.

Choice of the field player

Jonathan Barzideh, investment partner at Canyon Partners, points out that emergency situations in the current market are generally not caused by industry-specific factors like falling energy prices or declining patient numbers. Rather, he believes they are caused by the 'macro stressor of the Federal Reserve due to rising interest rates' and adds that many companies do not have enough liquidity to withstand these interest rates. A large percentage of today'scorporate balance sheets are designed for a zero Fed funds environment, he noted.

In fact, Barzideh sees the USA today as 'a story of two economies.' On one hand, he pointed to the 'revenge spending economy,' where consumers caught up on purchases and travel they missed during Covid. On the other hand, he referred to the 'Old Economy,' consisting of industrial, packaging, and chemical companies, which he believes may have already been in recession for a year, as they struggle with inventory reduction, labor shortages, supply chain issues, and reduced quantities.have.

Wiant from Capital Four also deals with higher interest rates and notes that interest coverage will worsen in 2024 as hedges are lifted and the maturity of bond debts is refinanced with papers with higher coupons, leading to an increase in cash interest expenses. He expects that the result is 'a lower error rate for many companies, even if they have healthy balance sheets and plenty of cash.'

In detail, Wiant sees a 'dispersion of results,' depending on whether companies meet or miss market expectations. 'Bonds show serious price distortions in response to bad news beneath the relative superficial calm of the market,' he said. Wiant added that the wide range of winners and losers he expects within and between sectors makes the opportunities potentially attractive, at least for the next few years.

Beach Point investor Schweitzer is also taking a broad approach - instead of a narrower, sector-based approach. He thoroughly examined the 'LBO deals of the years 2021-22' and found that many LBOs reach their 'highest risk' level in the third year, considering how debt agreements are structured and how much money sponsors generally provide initially to support their takeover. 'We're now entering this period,' he said, assuming that in 2024 opportunities will arise from this.asset class will emerge.

Ball four

Conversations with credit and distressed investors show that they are particularly focusing on four sectors: healthcare, media-telecommunication, software, and commercial real estate.

For example, healthcare was generally rejected as an investment sector for 2024. Burton from PineBridge pointed out that while labor inflation is now lower, companies are particularly exposed to risks from changes in reimbursement rates.

Houlihans Weinberger also called the reimbursement issue a problem for investors in healthcare. He pointed out that the number of doctors as well as the companies of nursing homes and rehabilitation centers are still struggling with the negative impacts of rising labor costs that are not offset by increasing reimbursements.

Nevertheless, some portfolio managers found reasons to like at least some parts of healthcare. Wiant from Capital Four assesses the sector as 'constructive' and points out that the strong rise in labor cost trends that has caused such margin damage to healthcare companies in recent years is likely over, and these costs are now 'normalizing' and producing a more favorable outlook.

Wiant particularly liked hospitals, outpatient surgery centers, nursing care, and aftercare. On the other hand, Wiant avoids companies in healthcare related to radiology, anesthesiology, and dialysis.

Triple play

Commercial real estate is another distressed sector on investors' radar. Barzideh from Canyon points out that $2.3 trillion in CRE debt will be due in the next four to five years, yet he sees the sector simultaneously affected by three dynamics.

First, higher interest rates increase capital costs while rising capitalization rates lower valuations. Second, there are changes in the use of properties. Barzideh points out that retail has realigned to benefit from changing consumer shopping habits, and that some class B office spaces in certain cities could be completely outdated.

The third dynamic is migration patterns. The real estate sector faces negative impacts when people leave areas with high taxes and urban areas to seek more space.

As for the real estate sector, Wiant from Capital Four has avoided the strained retail sector as he sees less recovery in this sector. However, he would make an exception for companies with particularly strong brand names. He is especially 'cautious about debt structures where value can be shifted away from creditors.'

In another struggling sector, the technology sector, Jacob from Marathon likes that many software companies have recurring revenue streams and at least some moats around their businesses.

On the other hand, Barzideh from Canyon said that many software companies grew through rollup strategies and were designed for a zero-interest-rate environment due to high initial multipliers, making them vulnerable in the current interest rate system. They also feel the 'revenue pressure' from the weakening US economy.

To put it bluntly, Schweitzer from Beach Point noted that many software deals are structured with 'high leverage and quirky financing that came with many adjustments.' He said Beach Point is 'thoughtful and smart' about how it enters the distressed part of the sector.

Another consistently unpopular sector is telecommunications. Houlihans Weinberger pointed out that the company is struggling with the 'wave effect' of consumer cable cuts, other changing consumer preferences, and higher interest rates, and therefore has less money available for capital expenditures.

Burton from PineBridge also pointed to the long-term secular trends that are working against the media and telecommunications industry, noting that '[the sector] is not cyclical and investors are questioning both their business models and their ability to refinance.'

Regarding those who have the courage to enter the media/telecommunications sector, Wiant from Capital Four pointed out that the metrics are declining, which affects potential recoveries, especially in broadcasting and cable.

While searching for offshore investment opportunities, Zwirn from Arena noted that he sees chances in distressed loans and troubled debt in Southern Europe and the UK, as well as new emergencies in Scandinavia and Germany.

In Asia, Zwirn avoids highly publicized and politically sensitive situations arising from China. However, he has discovered opportunities in China outside of public interest, as well as difficult and special situations in Korea, Japan, and Southeast Asia.